FIF Classe Investimento Vivest FOF Multimercado Enquadrado RL

Cotistas Totais da casca

10Patrimônio Total da casca

R$ 44,26 miAdaptação RCVM 175

20/06/2025

Classes e Subclasses do Fundo

Lista completa de classes e subclasses disponíveis, incluindo informações sobre patrimônio líquido e número de cotistas.

| Classes | Patrimônio LíquidoPL | Cotistas | |

|---|---|---|---|

| Classe | R$ 44,26 mi | 10 |

Classe ou subclasse

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Ver classe e subclasse

Classe ou subclasse

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

| Classes | Patrimônio LíquidoPL | Cotistas |

|---|---|---|

| Classe | R$ 44,26 mi | 10 |

Características da classe

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

- Status da classe

- EM FUNCIONAMENTO NORMAL

- Primeira cota

- 01/02/2006

- Categoria CVM

- Multimercado

- Categoria ANBIMA

- Estratégia Livre

- Tipo ANBIMA

- FIF

- Benchmark

- Não se aplica

- Composição do fundo

- FIF

- Investe 100% Offshore

- NÃO

- Previdência

- NÃO

- Forma de condomínio

- -

- Tributação Longo Prazo

- NÃO

- Código CVM

- 7793733000170

- Tipo de Investidor

- Profissional

- Exclusivo

- Sim

- Condomínio

- -

Patrimônio Líquido

R$ 44,26 miRentabilidade 12M

Índice de Sharpe 12M

Cotistas

10PL Médio 12M

R$ 86,75 miAdaptação RCVM 175

20/06/2025

Conheça o Consolidador de Carteira Profissional da Mais Retorno

Com o Retorno Pro, você consolida tudo em um único relatório e acompanha várias carteiras de forma muito mais simples e precisa.

Gráfico de Rentabilidade

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

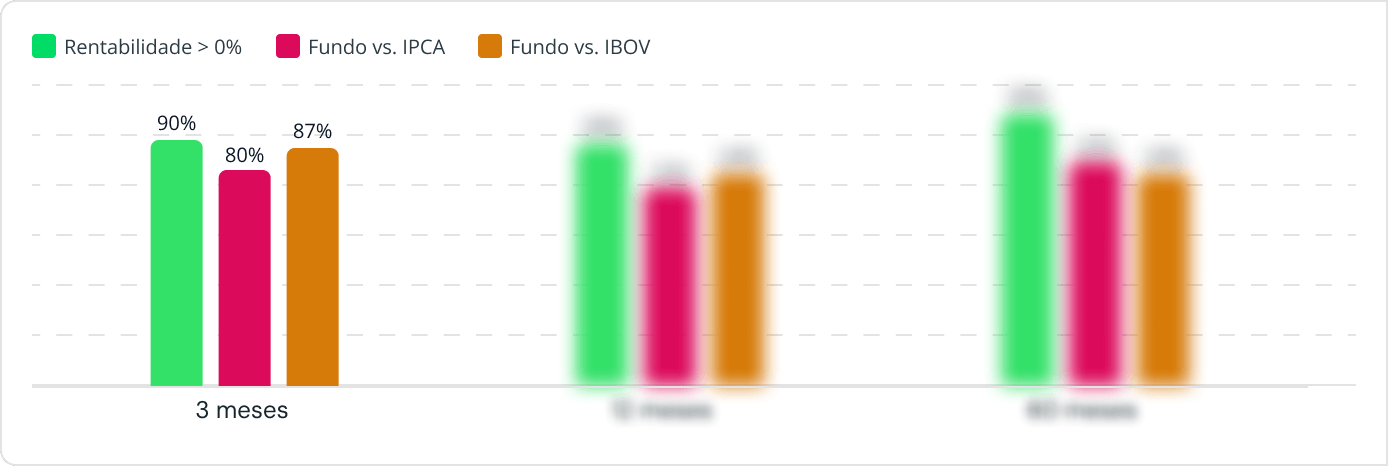

Taxa de Sucesso

% das vezes em que este fundo tem uma rentabilidade maior que um indicador em uma janela móvel

Descubra o histórico de sucesso do fundo

Assine o Retorno Prime e tenha acesso a todas as métricas de janelas móveis.

Descubra quantas vezes o fundo apresentou rentabilidade positiva ou positiva ou bateu um índice, considerando diferentes janelas de investimento.

Rentabilidade histórica

ANO | Jan | Fev | Mar | Abr | Mai | Jun | Jul | Ago | Set | Out | Nov | Dez | No ano | Acumulado |

|---|

Índices de Rentabilidade

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

No Mês | No Ano | 3 Meses | 6 Meses | 12 Meses | 24 Meses | 36 Meses | 48 Meses | 60 Meses | Total | |

|---|---|---|---|---|---|---|---|---|---|---|

| Rentabilidade | - | - | - | - | - | - | - | - | - | - |

| Volatilidade | - | - | - | - | - | - | - | - | - | - |

| Índice de Sharpe | - | - | - | - | - | - | - | - | - | - |

Consistência

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Fundo | Meses Positivos | Meses Negativos | Maior Retorno | Menor Retorno |

|---|---|---|---|---|

| FIF CLASSE INVESTIME... | -0,00% | -0,00% | - | - |

Composição da carteira

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Cotistas

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Drawdown

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Patrimônio

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Volatilidade

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Dúvidas Frequentes do fundo

FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Não conhece algum termo? Não entendeu os cálculos? A gente explica tudo pra você!

Qual a estrutura desse fundo?

Este fundo é composto por 1 classe, sendo ela:

- FIF CLASSE INVESTIMENTO VIVEST FOF MULTIMERCADO ENQUADRADO RL

Quantos cotistas o fundo tem?

O fundo possui 10 cotistas, consolidando os cotistas de todas as suas classes.

Qual a diferença entre Fundo (casca), Classe e Sub-classe?

Com a Resolução CVM 175, os fundos passaram a ter uma estrutura mais flexível e organizada:

- Fundo (casca): é a estrutura jurídica única, com regras gerais de governança e administração.

- Classe: representa cada estratégia de investimento com política, tributação e taxas próprias, além de patrimônio independente.

- Subclasse: variação comercial da classe, com as mesmas regras de investimento, mas condições diferentes (como taxas ou prazos).